The Power of Direct Mail in Financial Services

Direct mail offers a tangible, personal touch that digital marketing often lacks. For individuals seeking financial services like small business loans, receiving a well-crafted piece of mail can make a significant impact. It conveys a sense of legitimacy and trust, which is particularly important when dealing with financial matters. Here’s why direct mail stands out:

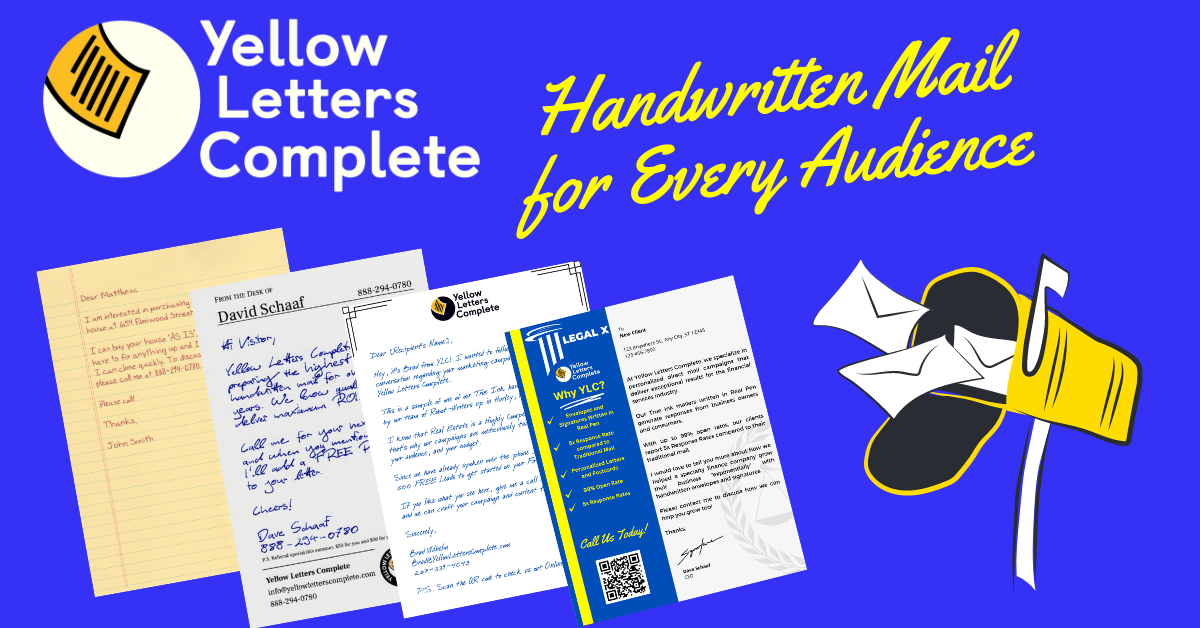

Personalization and Targeting

Direct mail allows for a high level of personalization. By utilizing data analytics, financial services companies can create targeted campaigns that address the specific needs and concerns of small business loan seekers. Personalizing mailers with the recipient’s name, business information, and tailored loan offers can significantly increase engagement and response rates.

Tangible Credibility

In an era where digital scams are prevalent, a physical piece of mail can convey credibility and trust. Well-designed direct mail pieces, featuring professional layouts and clear, concise information about loan products and services, can help establish your financial institution as a trustworthy partner for small business owners.

High Engagement Rates

Direct mail continues to deliver higher engagement rates compared to many digital marketing channels. According to the Data & Marketing Association, direct mail has a response rate of up to 9% for house lists and 5% for prospect lists, significantly higher than email marketing. For financial services businesses, this means a greater likelihood of reaching and converting potential clients.

Effective Direct Mail Strategies for Reaching Small Business Loan Seekers

To maximize the effectiveness of direct mail campaigns, it’s essential to employ strategies tailored to your target audience. Here are some key strategies to consider:

Data-Driven Targeting

Start by identifying and segmenting your target audience. Use data analytics to understand the demographics, behaviors, and needs of small business owners in your area. This information will help you craft targeted messages that resonate with potential loan seekers.

Compelling Content

The success of a direct mail campaign hinges on its ability to capture attention and motivate action. Ensure that your mailers feature compelling content, including:

- Personalized Messaging: Address recipients by name and reference their business to create a personalized connection.

- Clear Call-to-Action: Encourage recipients to take the next step, whether it’s visiting your website, calling for a consultation, or attending a financial planning workshop.

- Customer Testimonials: Include success stories from other small business owners who have benefited from your loan services to build trust and credibility.

Professional Design

A well-designed mailer can significantly enhance its impact. Use high-quality materials, professional layouts, and eye-catching graphics to make your direct mail pieces stand out. Ensure that the design aligns with your brand and conveys a sense of professionalism and trustworthiness.

Integration with Digital Channels

Combine the power of direct mail with your digital marketing efforts to create a cohesive multi-channel strategy. For example, include QR codes or personalized URLs (PURLs) on your mailers that direct recipients to a dedicated landing page. This approach not only enhances the customer journey but also allows you to track responses and measure the effectiveness of your campaigns.

Measuring Success and Refining Strategies

One of the key advantages of direct mail is its measurability. By using tracking codes, dedicated phone numbers, and unique URLs, you can monitor the performance of your campaigns in real-time. Analyze response rates and conversions to gain insights into what works and what doesn’t. Use this data to refine your strategies, ensuring that each subsequent campaign is more targeted and effective.

Direct mail remains a powerful tool for financial services businesses looking to reach small business loan seekers. Its ability to create a personal, tangible connection with recipients, combined with high engagement rates and targeted messaging, makes it an invaluable component of any marketing strategy. By leveraging data-driven insights, compelling content, and professional design, you can optimize your direct mail campaigns to generate high-quality leads and drive business growth.

As you navigate the competitive landscape of financial services, don’t overlook the impact of direct mail. It’s a proven method for connecting with potential clients and helping them achieve their financial goals, while also strengthening your brand’s presence and credibility.